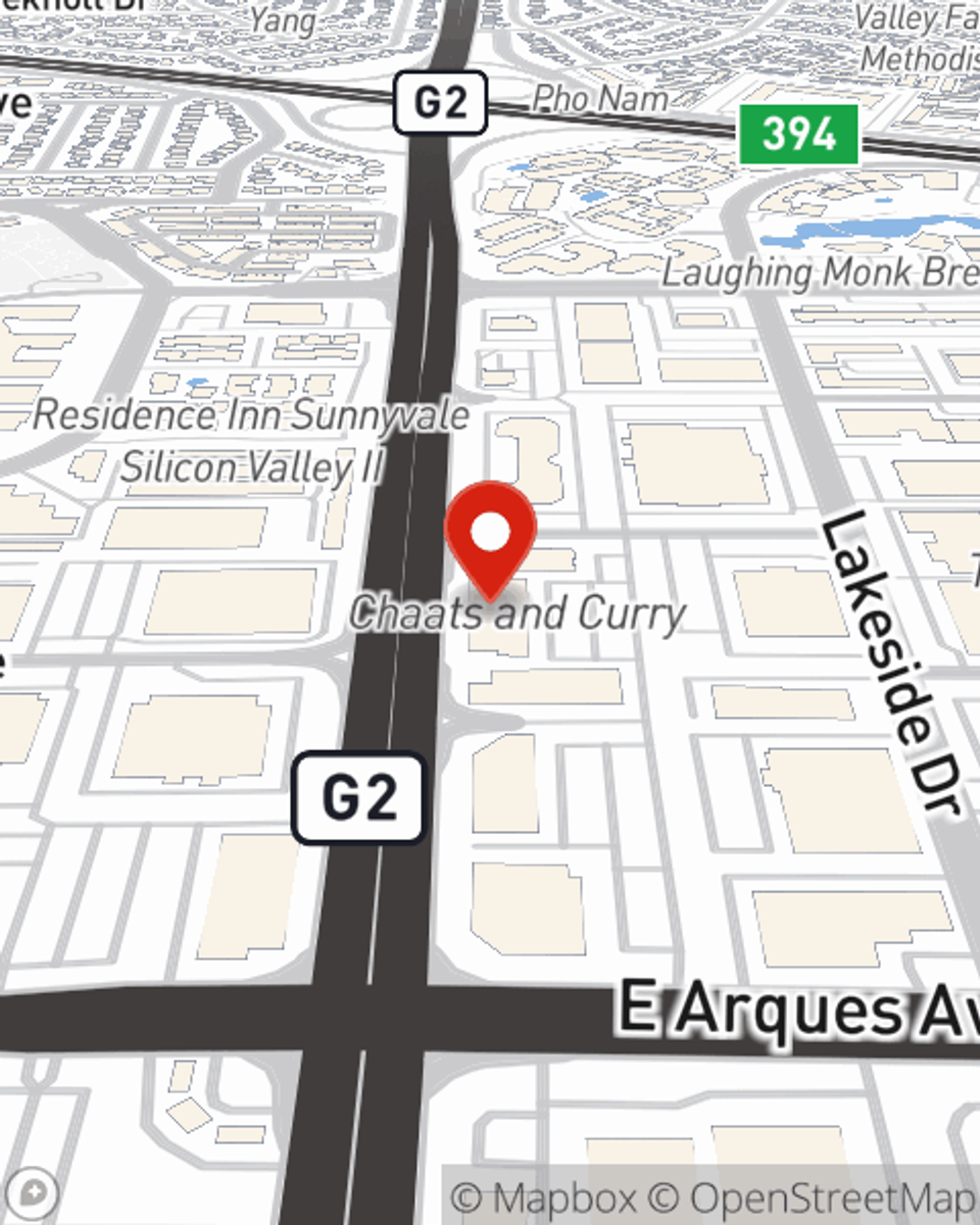

Life Insurance in and around Sunnyvale

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

Be There For Your Loved Ones

If you are young and a recent college graduate, it's the perfect time to talk with State Farm Agent Jacklyn Dinh about life insurance. That's because once you buy a home or condo, you'll want to be ready if tragedy strikes.

Protection for those you care about

What are you waiting for?

Sunnyvale Chooses Life Insurance From State Farm

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific time frame or another coverage option, State Farm agent Jacklyn Dinh can help you with a policy that can help cover your loved ones.

As a reliable provider of life insurance in Sunnyvale, CA, State Farm is ready to protect those you love most. Call State Farm agent Jacklyn Dinh today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Jacklyn at (408) 702-2602 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Jacklyn Dinh

State Farm® Insurance AgentSimple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.